How big is the size of the crypto lending market?

Crypto lending seems rather boring at first sight: Savings accounts and loans – what's new about that? But when you delve into what crypto lending really is, you will realize that it introduces an innovative financial product and a new form of collateralizing loans. It provides opportunities to savers and borrowers that the traditional financial industry cannot offer, and it will fundamentally change the way we save money and access liquidity.

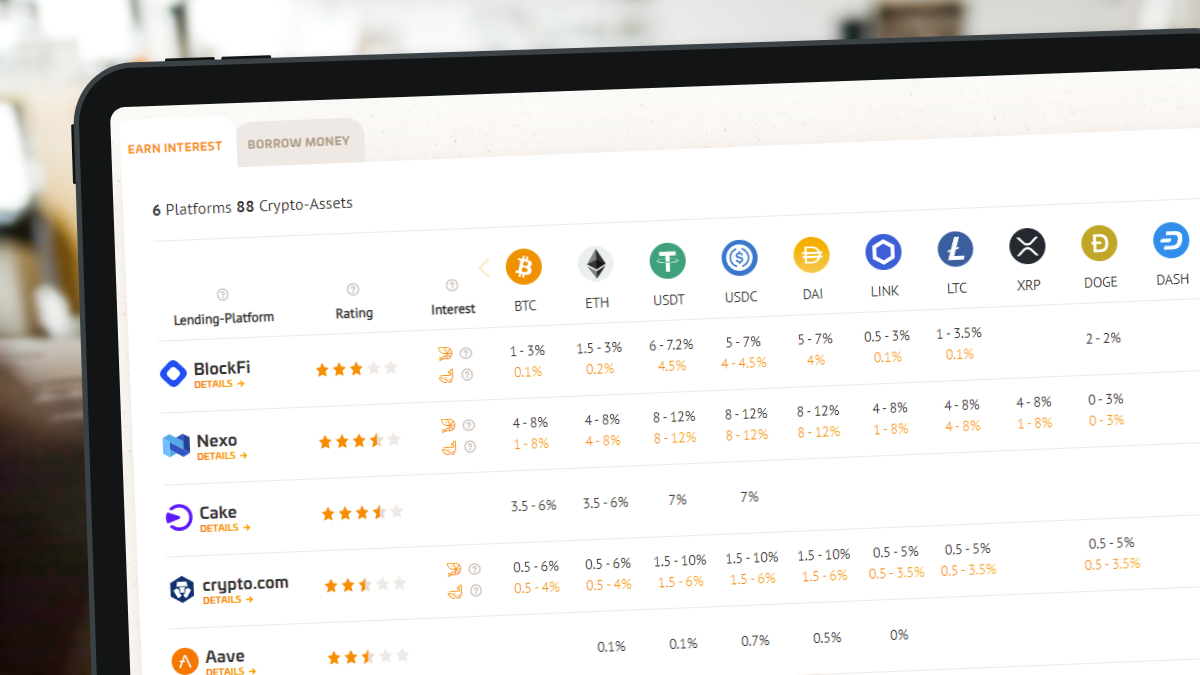

The rapid growth of the crypto lending market is a good indicator of how disruptive crypto lending will be over the next few years. The three biggest CeFi lending platforms have grown their Assets under Management by 734 percent alone in 2020. BlockFi each hold more than 4 billion US dollar worth of assets, Nexo has an AuM of about 2 billion US dollars. The three largest DeFi platforms have almost a combined 7 billion US dollars worth of assets locked on their platforms.

Despite the fast growth of the asset class, many investors still focus predominantly on the risks of crypto lending. And while you certainly should consider the risks of your investments, crypto lending offers you many ways to reduce those risks and optimize your returns. So above all, you should understand the enormous opportunities crypto lending offers for financial markets, both for the crypto financial system and for the traditional financial industry – and in particular for you as an investor or borrower.

Bill Gates

Efficiency gains through automation

The real innovation of crypto lending is the use of digital collateral to secure loans. Digital collateral eliminates the need for banks to perform expensive and time-consuming credit checks, and you can get a loan within seconds. On crypto lending platforms, borrowers provide this collateral in cryptocurrencies like Bitcoin, Ethereum, or USD Tether. Theoretically, however, you could use any form of digitized collateral such as real estate or stocks, as long as they are available in a digital format.

Already today, you can digitally represent almost any asset in the form of a digital token, and that's where the future of crypto lending lies. For example, if you want to take out a real estate loan today, the bank will estimate the value of your house. That takes time, costs money, and creates paperwork. Using blockchain technology, real estate can now be tokenized, meaning the data of your property is stored in digital form in a token, for example, the location, size, number of rooms, year of construction, purchase price, and current market value; the token contains everything that makes up the value of your property. This digital token is just a database entry and kind of a digital clone of your property. In the future, all you have to do is deposit the token of your property, and you can get a loan for it immediately - without a bank, without bureaucracy, worldwide, and in a matter of seconds.

Other assets will also be tokenized. Jay Clayton, Chairman of the U.S. Securities and Exchange Commission (SEC), recently said that all stocks might be tokenized in the future. Actually, pretty much every type of asset might get tokenized in one day.

This form of digitization and automation will speed up lending. Liquidity will flow faster, companies can finance projects more quickly, and as a result, the economy can grow faster. Just as the invention of email has facilitated communication, crypto lending will accelerate the flow of money. This will make the economy more efficient, and access to money will become easier and cheaper for companies and individuals.

Deloitte projects by 2025 that 10% of global GDP to be built on blockchain applications | #BigData #Analytics #RT https://t.co/MCfwTrTViS pic.twitter.com/G5XvaLCywj

— Ronald van Loon (@Ronald_vanLoon) September 8, 2017

Consulting firm Deloitte says 10% of global GDP will be built on Blockchain-applications by 2025

A global and inclusive lending market

Today, you will often read about the "global financial market," but such a market doesn't really exist. Have you ever tried to take out a bank loan in another country or transfer money to the other side of the world?

Compared to the traditional banking system, liquidity can flow almost instantly in the crypto financial system. Money flows directly from sender to receiver and does not have to be transferred across multiple banks, which takes time and costs money. In crypto lending, national borders are irrelevant primarily because crypto loans are secured by cryptocurrencies. As these assets are publicly listed, their market value is transparent for everyone worldwide. A US-based crypto lending platform doesn't care if a borrower or saver lives in China or Europe because the value and liquidity of the collateral are all that matters.

crypto lending also no longer requires a credit check. It is mostly irrelevant where you live, how high your income is, how reputable you appear at the bank interview, or what nationality is written in your passport. In the crypto financial system, even people who cannot participate in the traditional financial system - for example, refugees who have no documents to prove their identity or the source of their assets - can also participate in the global exchange of values.

This is about where we are in the blockchain evolution of things. pic.twitter.com/ez0S2gazvt

— CZ Binance (@cz_binance) January 17, 2021

CEO of the crypto-exchange Binance

The end of the banking oligopoly

Today, just a handful of large banks dominate the financial system. In the U.S., four banks hold 45% of all bank deposits. Since the financial crisis in 2008, the power of the largest U.S. banks has even increased. That has increased systemic risks, as the collapse of one large bank would rock the entire global economy. It also means banks can impose higher prices on customers – right, that's you - and have the power to decide who should have access to the financial system and who should not.

Big 4 US banks hold 45% of customer deposits. Why unbundling of banks is a thing. https://t.co/ZhGdG0BteS pic.twitter.com/2BYTdegg8l

— CB Insights (@CBinsights) February 4, 2016

The 4 largest US-banks hold 45% of deposits

Blockchain could break up this banking oligopoly. It allows direct value exchanges between users of the financial system without the need for financial intermediaries. People - and machines - can send money directly to recipients without a bank account. Investors can buy stocks directly from companies without a broker. And savers can send money directly to borrowers, without loan intermediaries.

There are two types of crypto lending platforms today: CeFi ("Centralized Finance") and DeFi ("Decentralized Finance") platforms. CeFi platforms are operated by a private company that owns the platform. Like a broker or a bank, this company profits from the exchange of liquidity between savers and borrowers. DeFi platforms, on the other hand, are not backed by a company that organizes this exchange. Instead, the entire process is based on a technological protocol, a smart contract, which handles the lending processes completely automatically. Crypto lending therefore no longer requires banks, but either a CeFi provider or a DeFi protocol.

One could now argue that CeFi providers can only replace banks but do not abolish them, and thus do not solve the problem of power concentration in the financial system. And while that's true to a certain extent, these platforms could only replace part of the banking business. In other words: They stimulate competition in the financial industry by attacking a core part of the banking value chain.

DeFi platforms, on the other hand, could ultimately replace banks one day - and they could one day also replace CeFi providers - with a decentralized blockchain protocol. Today, most crypto lending still takes place with CeFi providers because most investors prefer to trust a company rather than a protocol. However, this could change in the future because technology is constantly evolving. Also, the upcoming generation has a different attitude towards technology and will more often choose the protocol over the company. If DeFi platforms establish themselves in the long term, no company will earn a share of the liquidity transfer through fees or interest rates anymore. As a result, the cost of using the financial system would decrease. Crypto lending, both CeFi Lending but especially DeFi Lending, could contribute massively to the democratization of the financial system, break up existing oligopolies, reduce costs, and offer alternatives to traditional savings accounts and fixed-term deposits, and reduce the systemic risks of the financial system.

Crypto market stability through liquidity

Since cryptocurrencies are still a nascent asset class, liquidity in the market is low, which causes high volatility. The lack of liquidity also creates arbitrage opportunities, for example, if different crypto exchanges have different liquidity levels. Crypto lending provides liquidity to institutional investors such as hedge funds, crypto exchanges, or market makers, allowing them to exploit these arbitrage opportunities. The more market participants engage in arbitrage trading, the smaller these arbitrage opportunities become and the more efficient and stable the overall crypto market becomes. Crypto lending thus makes a significant contribution to the development of the entire asset class.

The alternative to the low interest rate environment

Crypto savings accounts yield between 3% and 10% interest, depending on the platform and product, and sometimes even more. In contrast, you get almost no interest at your bank, and some banks now even charge negative interest. Crypto lending offers you an attractive return, while you can withdraw your assets at any time, just like at the bank. It offers a way to invest liquid funds profitably in the short term until you need them for investments or expenses.

Interest-bearing investment products are essential for institutional investors and companies that temporarily have large sums of money at their disposal and need to generate a return on it. Until now, savings accounts, term deposits, and short-term government bonds served this purpose. All these instruments have now been rendered worthless by the zero interest rate policy, and it is not likely that interest rates will increase in the foreseeable future. Those who want to earn higher rates on their money have few alternatives in today's markets.

.png)