You may have already noticed in our crypto lending platform review that we show a "Shrimp" and "Whale" rate for each crypto savings account and a "base" and a "minimum" rate for each crypto-backed loan. The spreads between these rates can be significant.

The reason for these spreads is that many crypto lending platforms offer different investment options, each paying out different interest rates. So, just like with banks, the "one-and-only" interest rate doesn't exist, but there are different ways to optimize your yield in accordance with your risk profile. Likewise, if you are a borrower, you can reduce your borrowing rates to get access to cheaper finance.

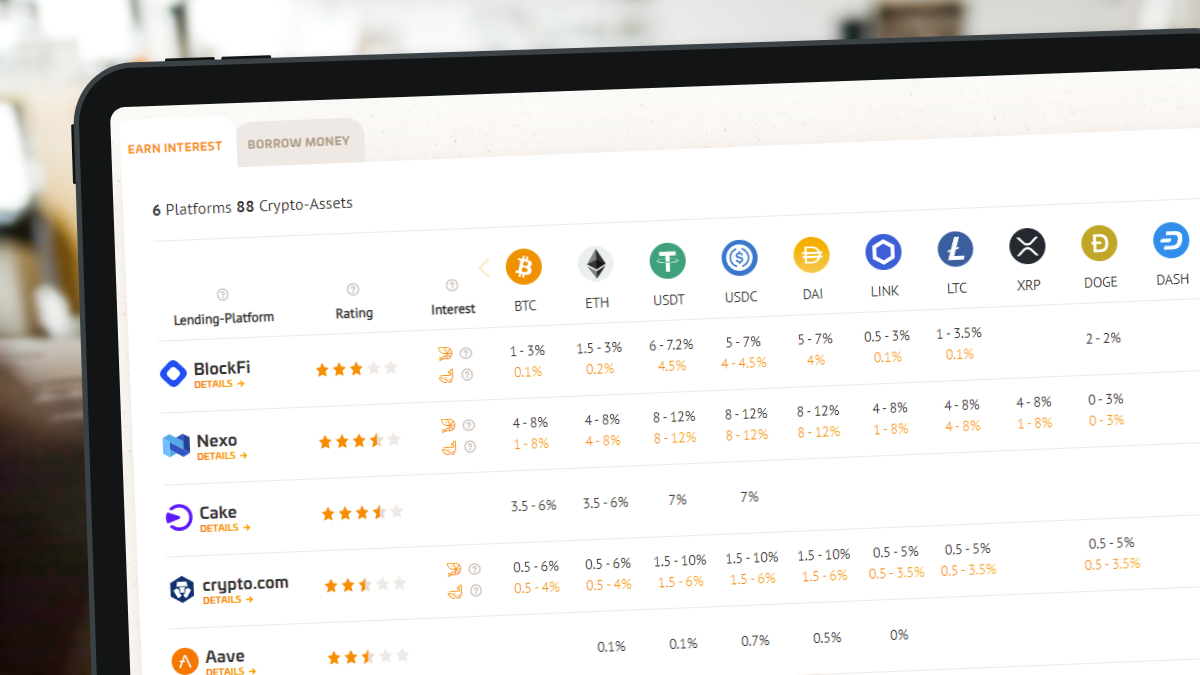

Crypto lending interest rates in our review table

Crypto lending interest rates in our review table

Our crypto lending rates table shows a Shrimp and a Whale rate, although lending providers usually do not use this terminology. Many lending providers offer tier rates, where they tie the interest rates to the amount you deposit on the platform. The Shrimp rate is the rate you get for a lower deposit amount. The whale rate is the rate for higher deposit amounts. The exact definition of what a shrimp or a whale is differs from platform to platform, check the Info-I next to the Shrimp/ Whale symbol at the respective provider for more detail. We show a range for the Shrimp/ Whale rates, because besides the deposit amount, you can also get a higher rate if you meet certain other conditions, for example, loyalty status (that means you need to buy their platform token), lock-up periods, or if you select the platform token as the payout currency. Typically, most retail investors will end up in the Shrimp tier, while wealthier investors will deposit enough funds to end up in the whale tier. Also, be aware that this is a tier structure. That means you will get the Shrimp rates for the initial sum, and the whale tier for the sum exceeding the Shrimp tier.

Albert Einstein

Crypto lending optimization tip 1: Crypto lending with stablecoins

If you are looking at crypto savings accounts, you first need to decide in which cryptocurrency you want to invest your money. On most platforms, you can invest with volatile cryptocurrencies like Bitcoin or Ethereum, or with stablecoins, meaning coins that are pegged to a stable underlying such as the U.S. dollar or gold. On some platforms, you can also invest directly with fiat currencies such as the U.S. dollar or the euro.

Suppose you invest in a volatile cryptocurrency like Bitcoin or Ethereum. In that case, the crypto lending platform cannot use your cryptocurrencies to provide fiat loans to borrowers without volatility risk. However, if you invest a stablecoin like USD Tether, the lending provider can use your cryptocurrencies to issue U.S. dollar loans without volatility risk. Since the lending providers' loans are mostly denominated in fiat currencies or stablecoins, stablecoins are of higher value to the platform providers – and that's why you typically get higher interest rates for stablecoins. While you get between 2% and 4% interest for Bitcoin or Ethereum, you can get up to 10% interest with stablecoins, depending on the platform. The difference is significant, and that's why stablecoins lending is our first tip to earn the highest crypto interest rates.

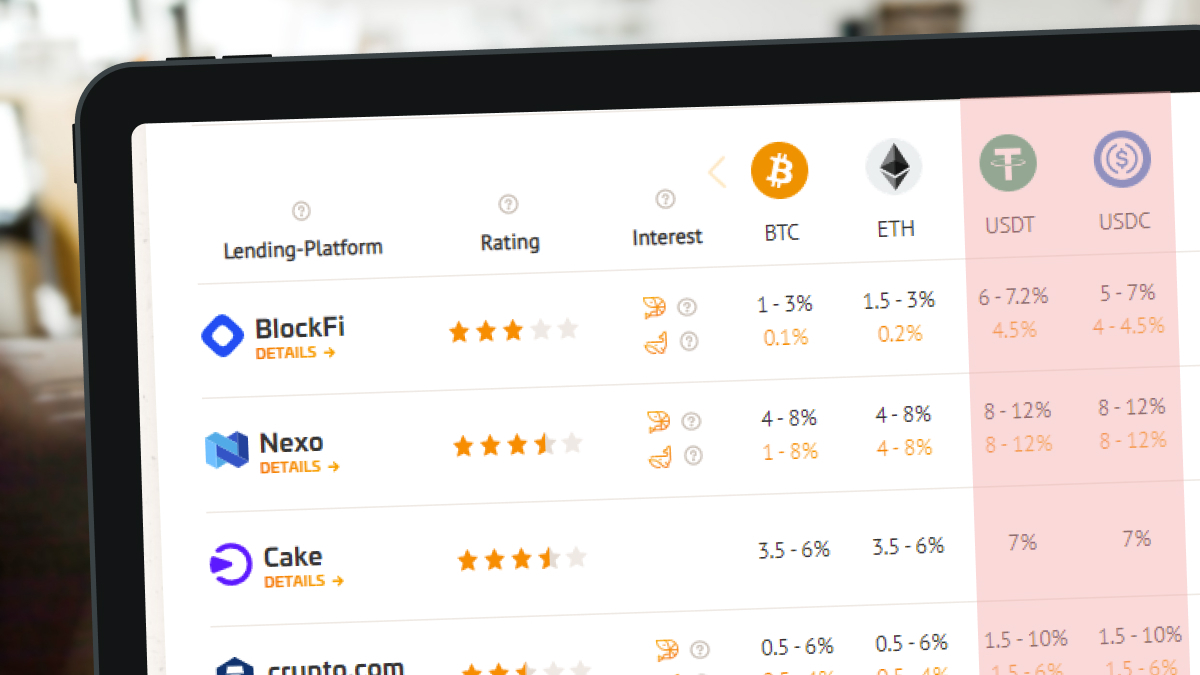

Using stablecoins as collateral for higher crypto lending interest rates

Using stablecoins as collateral for higher crypto lending interest rates

On the contrary, if you invest your money in a volatile cryptocurrency like Bitcoin, you not only earn a lower interest rate, but you also bear the volatility risk. Your investment value will fluctuate during the investment period, which means you could receive lower interest payments. Of course, the upside is that your investment can also rise in value, which means you could also earn significantly more money. If you invest your money in stablecoins, your volatility risk is significantly lower, and so is your potential upside.

That you get higher rates on stablecoins may sound confusing at first because your returns are higher although your risk is lower – which does not correspond to the risk-return paradigm of the traditional financial world. However, in the crypto-financial world, instability is inherent in the system, so investors are rewarded for stability.

When you invest with stablecoins, you also have to keep in mind that you may be carrying an exchange rate risk. For example, if you exchange euros for a stablecoin tied to the U.S. dollar, such as USD Tether (USDT), any changes in the U.S. dollar value will affect your euro wealth. However, compared to Bitcoin's volatility, the fluctuations of major fiat currency pairs are relatively small.

Crypto lending optimization tip 2: Invest in native lending platform tokens

Some crypto lending Platforms issue their own native cryptocurrencies, also called "lending tokens," for example, Cake (DFI), Crypto.com (CRO), or Nexo (NEXO). Platforms that issue their own tokens want you to buy their tokens so that their value increases. That's why they offer you higher interest rates on your crypto savings accounts if you invest at least part of your funds in the respective lending token. The additional interest can boost your return to more than 10%, depending on the platform.

With some providers, you can also choose in which currency you want to receive your interest payments. Most platforms offer "in-kind" payments, meaning you receive your interest in the same currency in which your savings account is denominated. On some platforms, for example, BlockFi, you can also choose to receive your interest payments in another currency. For example, you can invest in Bitcoin and have your interest paid out in Ethereum. Sometimes there is also the option to receive your interest payments in the respective lending token, for example, with Crypto.com or Nexo. Then you can invest in Bitcoin, for example, but your interest is paid out in the CRO token or NEXO token. If you choose this option, you will also get a higher interest rate because you are essentially using your interest payments to buy the platform's lending token.

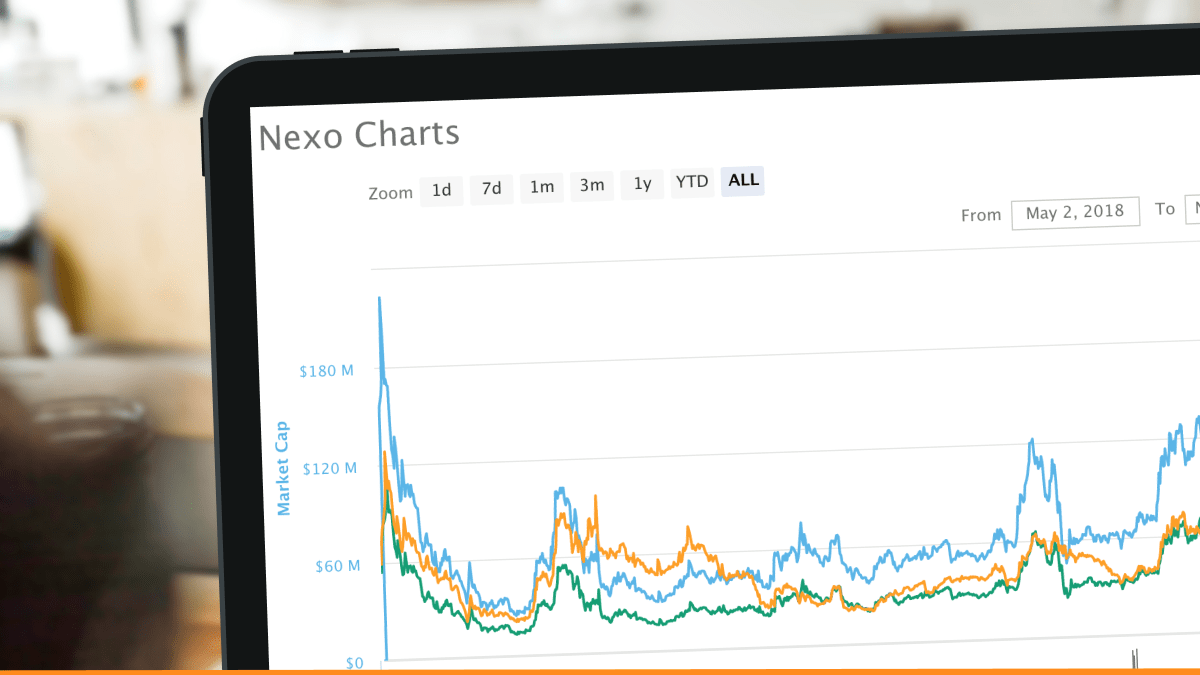

NEXO, the token of Nexo.io and its market capitalization as a chart

NEXO, the token of Nexo.io and its market capitalization as a chart

If you decide to go for the higher rates by investing or earning in lending tokens, keep in mind that these lending tokens have a low market capitalization and low liquidity compared to Bitcoin or Ethereum. Their volatility can be even higher, meaning potential price drops can easily offset the higher interest rates. On the other hand, the volatility can also work in your favor, and you can yield a higher triple-digit or even four-digit return. Thus, if the token increases in value, you will receive higher interest and benefit from a higher lending token valuation.

Before you invest in lending tokens, you should understand the business model, the "Tokenomics," of the lending platform. Most of these tokens are like penny stocks, the stocks of tiny companies. You may lose all your money if the token goes south, but it's also possible that your token value increases substantially if the company behind it turns out successful. It's crucial for you to understand that when investing in lending tokens, the higher interest rates you receive are only part of the investment decision; the key consideration is the platform provider's business model.

Crypto lending optimization tip 3: Commit to longer lock-up periods

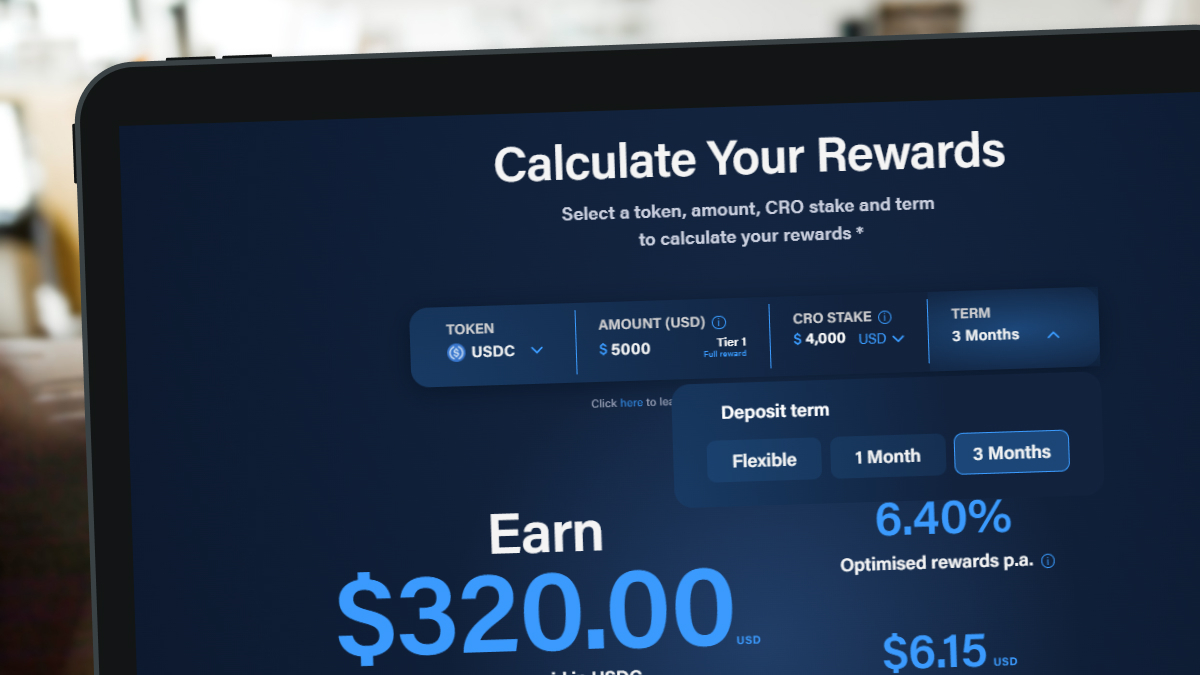

On many Lending platforms, there are no fixed investment periods; you can withdraw your money at any time. However, a few providers also offer fixed-term deposits, which work similarly to fixed-term deposits at the bank. For example, on Crypto.com you can choose between a flexible savings account and a 1-month or 3-month lock-up period. The longer you commit, the higher the interest rates.

Higher crypto lending interest rates due to longer, fixed terms (example: crypto.com)

Higher crypto lending interest rates due to longer, fixed terms (example: crypto.com)

Crypto lending optimization tip 4: Token dividends and bonuses

Some platforms offer additional incentives and bonuses in addition to the interest rates. For example, with Nexo, you get paid a dividend if you hold their NEXO token. With Cake, you get a bonus if your investment currency (Bitcoin or Ethereum) exceeds a certain price point, similar to an options contract. While these additional payments are not interest payments – and thus not included in the maximum rates displayed in our interest rates review – they can significantly increase your return.

Crypto lending optimization tip 5: Pay attention to Shrimp and Whale tiers

Some platforms offer higher interest rates for Shrimps or Whales, but mostly Shrimp tiers are offering higher rates. At BlockFi, for example, investors earn 3% for the first 0.1 Bitcoin. For 0.1 BTC to 0.35 BTC BlockFi pays 1% and for anything above 0.35 BTC rates fall to 0.1% (as of April 2022, rates may change). As most platforms offer higher rates for Shrimp tiers, you can increase your overall yield by spreading your funds over several platforms to take advantage of the higher rates for lower deposits.

The interest rate brackets at BlockFi

The interest rate brackets at BlockFi

Crypto lending optimization tip 6: How to reduce your borrowing rate

As a crypto saver, you want to increase your interest rate; as a borrower, you want to reduce it. Again, there are several ways to get a cheaper rate on your loans: First, you may provide some of your loan collateral in the form of the platform's native Lending Token, or you may pay your loan interest in Lending Tokens. In return for buying their Lending tokens, the platforms will usually give you a discount on your borrowing rate. Also, a lower Loan-to-Value (LTV) ratio typically comes with a cheaper borrowing rate. If you choose a lower LTV, you will have to provide more collateral, so the platform will receive more capital from you – and thus gives you a better rate. Not every platform will allow you to choose a lower LTV, but many do.

.png)