Crypto lending became a fundamental building block of the crypto financial market in 2020. The leading providers have seen massive growth, and lending platforms have become a key source of liquidity: A look back at the year 2020.

2020 was a boom year for the crypto asset class in many ways. The bitcoin price has nearly tripled since November, reaching a new all-time high. As institutional investors needed more liquidity and investors are looking for ways to generate cash flow with their cryptos, 2020 has also marked the kickoff for crypto lending. It's safe to say that crypto lending has now established itself as a core part of the crypto financial market.

Massive growth in CeFi and DeFi lending

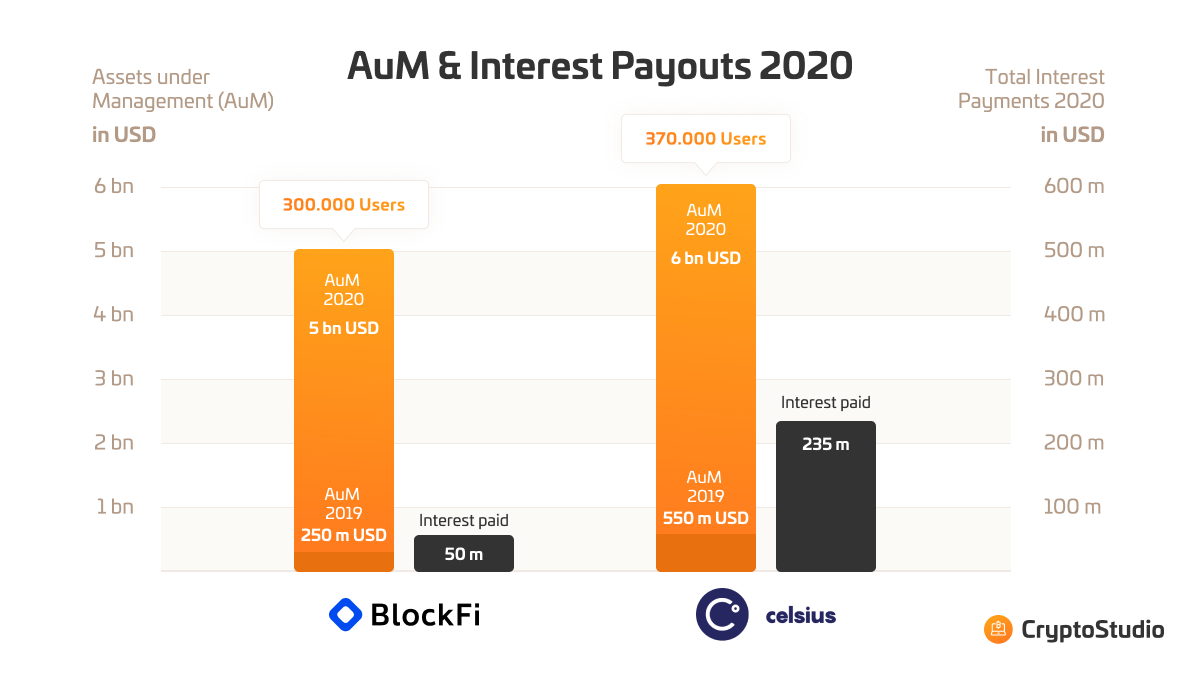

The largest crypto lending platforms have significantly grown their Assets under Management (AuM) and user bases in 2020. BlockFi posted an AuM of over $5 billion at the end of January 2021, up from $250 million at the beginning of 2020 - a growth of almost 2,000 percent. Celsius Network grew their AuM from $550 million to more than $6 billion.

However, both platforms distributed significantly different interest payments: Celsius Network paid out over $235 million in 2020, while BlockFi distributed "only" $50 million in interest payments. That said, BlockFi also paid out $28 million in interest in January 2020 alone, so their interest payments in 2021 are likely to be much higher than the previous year.

Another record breaking month of interest payments @BlockFi

Our clients earned over 28M in interest for January including >400 #btc, >4500 #ETH and >5M in stable coins

Also we increased Litecoin rates for Feb. Thank you!

In terms of user numbers, Celsius Network leads with 370,000 users and BlockFi counts 300,000 users. Some of the leading lending tokens have also gained massively in value. Celsius Network's CEL token gained over 3,000 percent in 2020. That means Celsius-savers who chose to cash out their interest in CEL tokens could profit twice: From the comparatively high interest rates and the CEL token's capital appreciation.

Source: Celsius Network, BlockFi

Celsius Network and BlockFi both closed funding rounds in 2020: Celsius Network raised $18 million in July via fundraising platform BNKtotheFuture. BlockFi closed a $52.5 million funding round in July, with participation from institutional investors such as Galaxy Digital.

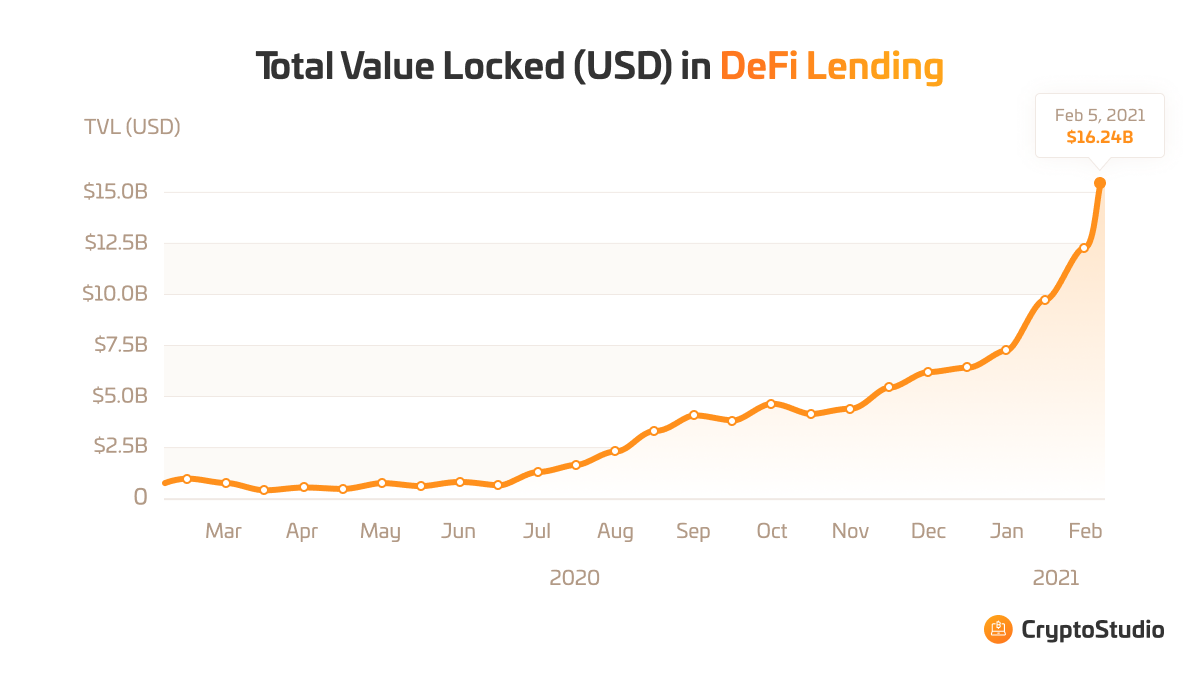

The DeFi lending market also saw strong growth in 2020. While there was about $500 million in capital locked on DeFi Lending platforms in January, their total AuM has increased to nearly $13 billion to date. The majority of the assets are concentrated on the three leading DeFi platforms, Maker, Aave, and Compound.

Source: DeFi Pulse

Crypto lending enables interest income and provides liquidity

There were several reasons for this massive increase in capital on CeFi and DeFi lending platforms: First, the crypto asset class has moved more into the mainstream. However, Bitcoin, just like most other cryptocurrencies, does not generate cash flows for investors per se. By allowing investors to earn interest on their cryptocurrencies, crypto lending adds another feature to crypto assets as an investment product.

As crypto trading became more popular in 2020, trading volumes on crypto exchanges have increased, which is why institutional investors needed to access liquidity more quickly. Crypto lenders provide this liquidity by lending their investors' cryptocurrencies to crypto exchanges or market makers. Camilla Churcher, Global Head of Business Development at Celsius Network, said in a post on Decrypt, "On the institutional side, growth has been similarly exponential […] A lot of activity in crypto has been taking off, more than ever in the last two weeks. More and more corporate customers [are] coming to our platforms."

Not only has cryptocurrency trading increased over the past year, but stablecoins are also increasingly in demand. Today, the stablecoin circulation is higher than $26 billion; that's $20 billion more than a year ago. Many investors are using their stablecoins to earn interest on crypto lending platforms without being exposed to the high volatility of cryptocurrencies like Bitcoin or Ethereum.

The state of the real economy also plays into the hands of crypto lending platforms. During the COVID crisis, central banks in Europe and the USA have cut interest rates. As a result, there is hardly any interest left on savings accounts, and in some cases, rates have even fallen into negative territory. Real yields on government bonds with high credit ratings are also negative at the long end of the yield curve, further limiting investors' opportunities to earn interest. All of that is unlikely to change anytime soon, as zero and negative interest rates have become the "new normal" for policymakers.

Negative Interest Rates Benefit the Global Economy, Says IMF Chief Christine Lagarde - WSJ “We see the recent introduction of (NIRP) by ECB & BoJ —though not without side effects that warrant vigilance—as net positives in current circumstances” REALLY?? https://t.co/rT5BAipJbP

Crypto lending as a core element of the crypto financial market

The crypto lending industry overcame a major hurdle in 2020: The Crypto Flash Crash in March was a systems test that demonstrated to investors the stability of the nascent crypto lending platforms. None of the leading providers disappeared from the market during or after the crash, and savers' capital was sufficiently protected by the collateral mechanisms created by the platforms.

Still, there was a lot of movement among the lending players last year: The American lending prover Cred filed for bankruptcy, and the Maker Foundation came under criticism in the wake of the crypto flash crash. Besides the two leading platforms Celsius and BlockFi, others also saw a spike in user numbers and capital inflows: Nexo increased their AuM to over $2 billion and Cake, a platform aiming at German-speaking users, has established itself on the market. Besides the larger platforms, there are also several smaller providers such as Crypto.com, CoinLoan, YouHolder, Salt Lending, Helio Lending, and Bank of Hodlers. Crypto exchange Gemini also recently announced its own crypto savings product called "Earn. "

#GeminiEarn early access is live for select customers!

With a Gemini Earn account, you can receive up to 7.4% interest on your #crypto.

✅Interest is earned daily

✅No minimums

✅Available in ALL 50 US states

✅No fees when you redeem your cryptohttps://t.co/VEW5nYSuHk pic.twitter.com/0YHp5haa0m

The rapid growth of crypto lending will continue in the coming year. In the traditional financial industry, collateralized securities lending is a core part of the system. It is considered a proven and safe concept, with all major banks and brokers participating. Crypto lending is the same concept, just for crypto assets.

Developments in 2020 have shown that crypto lending is crucial as a fundamental building block in the crypto ecosystem - similar to lending in the traditional financial industry. More and more platforms are trying to conquer the market with innovative offers. The competition is getting tougher and crypto savings accounts and crypto-backed loans are in greater demand. As the market grows, traders and exchanges will need more liquidity and investors want to invest their assets to earn interest. Crypto lending can do all of that to the benefit of savers and investors.